How to Start Investing in Mutual Funds: A Beginner’s Guide

How to Start Investing in Mutual Funds: A Beginner’s Guide

How to Start Investing in Mutual Funds: A Beginner’s Guide

Hey there, future financial guru! 🌟 So, you’re thinking about how to start investing in mutual funds—awesome move! Mutual funds are a fantastic way to kick off your investment journey. They’re like a tasty financial smoothie: a mix of different investments blended together to make your money work for you. But before you dive in, let’s walk through the basics and get you set up for success.

What’s a Mutual Fund Anyway?

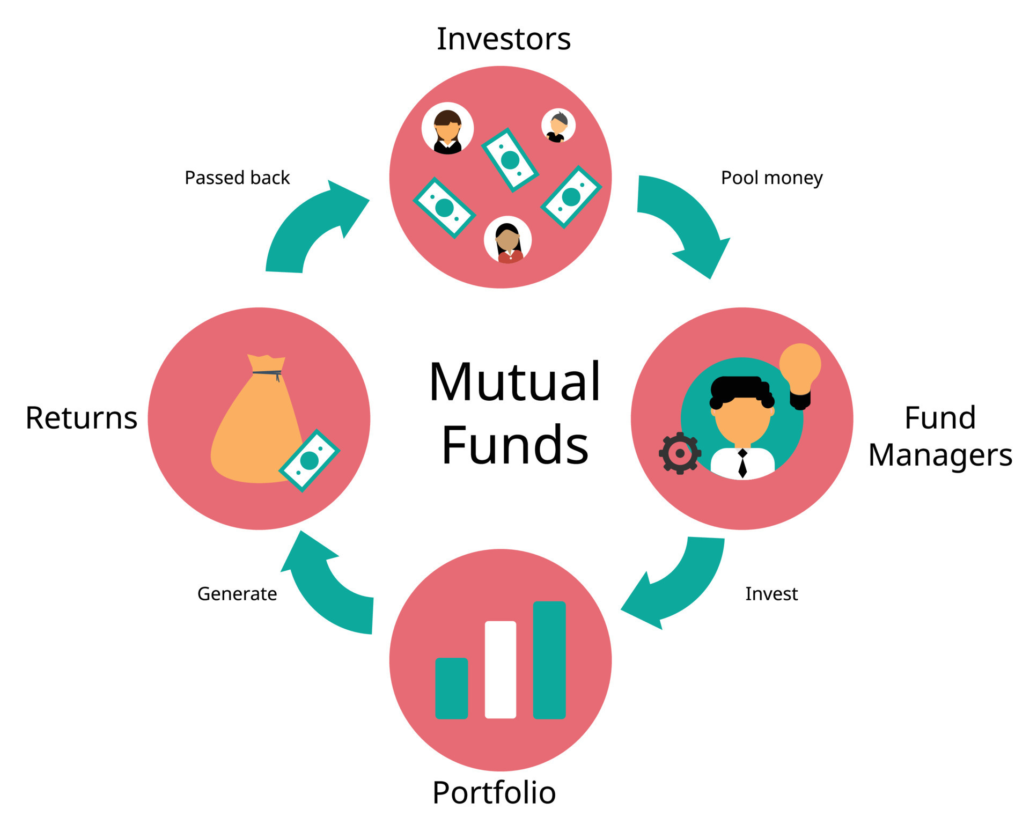

Alright, let’s break it down. A mutual fund pools money from many investors to buy a diverse range of investments, such as stocks, bonds, or other assets. Think of it like a team of investors all pitching in to buy a bunch of different stuff. This mix helps spread out risk and can lead to better returns.

Prerequisites to Invest in Mutual Funds

Before you start putting your hard-earned cash into mutual funds, there are a few things you need to check off your list:

- KYC Status Check:

Check your KYC Status on https://www.cvlkra.com/ -> Click on “KYC Inquiry” and enter your PAN number to check. If you are in “KYC Validated” status then congratulations, you are good to go! If it is anything other than that, you can get in touch with us to get it updated! - Financial Health Check-Up:

Make sure you’ve got your financial house in order. That means having a stable income, a budget in place, and an emergency fund to cover unexpected expenses. Mutual funds are a long-term investment, so it’s crucial to be in a good financial position before you dive in. - Understanding Your Goals:

Think about what you want to achieve with your investments. Are you saving for a future trip, a down payment on a house, or just looking to grow your money over time? Your goals will influence your choice of mutual funds. - Knowledge is Power:

Educate yourself about mutual funds. Know the basics of how they work, different types of funds (like equity, debt, or hybrid funds), and how they fit into your overall investment strategy. There are plenty of resources online, from blogs (ahem) to free courses. - Investment Account:

To invest in mutual funds, you’ll need an investment account. This could be through a brokerage firm, a bank, or a financial advisor. Many platforms make it easy to open an account online. Just be sure to choose one that suits your needs and has good customer support. - Know Your Risk Tolerance:

Different mutual funds come with different levels of risk. Some are more aggressive (think high potential returns, high risk) while others are more conservative (lower returns, lower risk). Knowing how much risk you’re comfortable with will help you choose the right fund.

Ideal Age to Invest in Mutual Funds

Wondering if you’re too young (or too old) to start investing in mutual funds? The truth is, it’s never too early to begin investing, especially if you’re in your late teens or early twenties. The sooner you start, the more time your money has to grow. Here’s why starting young can be a game-changer:

- Time Is On Your Side:

The earlier you start, the more you benefit from the magic of compound interest. Basically, you earn interest on your initial investment and on the interest that accumulates over time. It’s like your money is working 24/7 to make more money! - Learning Curve:

Investing while you’re young gives you plenty of time to learn and adjust your strategies. You can experiment with different funds and see what works best for you, all while you have time to recover from any mistakes. - Building Good Habits:

Starting early helps you develop good investing habits. You’ll get used to setting aside money regularly, monitoring your investments, and staying informed about financial markets.

Steps to Start Investing in Mutual Funds:

- Define Your Goals and Risk Tolerance:

Based on your financial goals and how much risk you’re comfortable with, we help you choose a mutual fund that fits your needs and goals. - Research Funds:

Based on your needs and goals, we do the hard work for you and look for best mutual funds amongst 2500+ funds available in market. We shortlist on the basis of their past performance, future market trends, expense ratio and the types of assets they invest in. - Open an Investment Account on Mobile:

Download the mobile app for Android or Apple device and start 15-min quick and straight-forward onboarding process. We will guide you through it as well. - Start Small:

You don’t have to invest a ton of money right away. Start with an amount you’re comfortable with and increase it gradually as you get more confident. - Monitor and Adjust:

Keep an eye on your investments through our Mobile App and how they’re performing. We also help you adjust the strategies if needed based on your changing goals or financial situation.

Final Thoughts

Investing in mutual funds is a smart move to grow your money over time. By checking your financial health, understanding your goals, and starting early, you’re setting yourself up for financial success. So, get out there, do your research, and start investing—your future self will thank you!

Got any questions or need more tips on how to start investing in mutual funds? Drop them in the comments, and let’s get this investment journey rolling! 🚀💰

By understanding how to start investing in mutual funds, you’re taking a significant step towards financial independence and a secure future. Happy investing!

The blog is designed welll